Federal unemployment withholding calculator

To use it you answer a series of questions about your filing status dependents income and tax credits. The easy-to-use IRS Tax Withholding Estimator is on the IRS website.

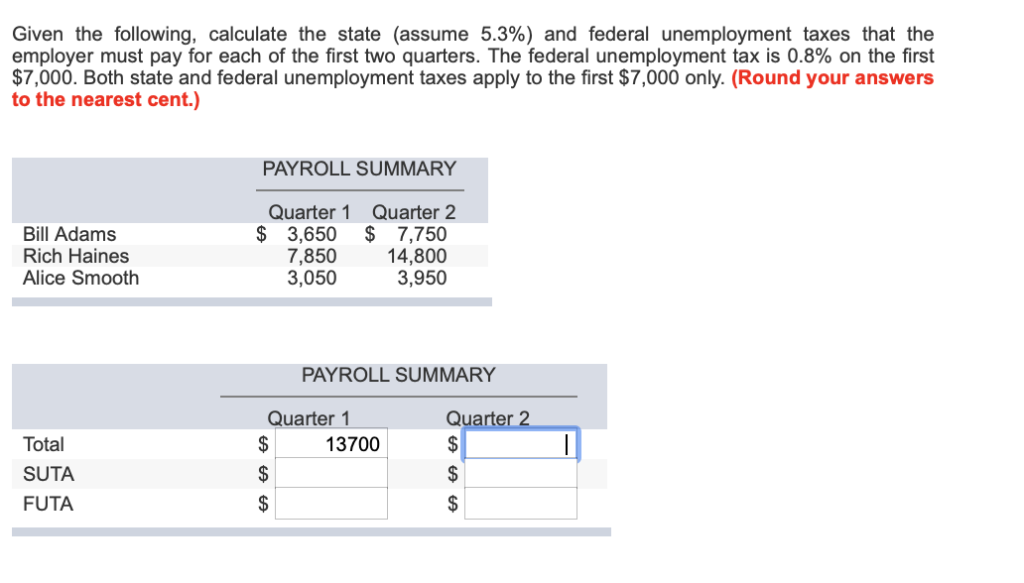

Solved Given The Following Calculate The State Assume Chegg Com

This version removes the use of allowances along with the option of claiming personal or dependency exemptions.

. Employers are subject to unemployment taxes by the federal and all state governments. Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Payroll unemployment government benefits and other direct deposit funds are available on effective date of settlement with provider.

Where can I get withholding tax returns. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation. The federal income tax withholding tables are included in Pub.

The individual states impose payroll taxes of the second type. Here are step-by-step instructions for using the calculator. You can opt to have federal income tax withheld when you first apply for benefits.

Beginning July 2013 withholding tax returns and withholding tax payments must be filed and paid electronically using one of our three online systems. Federal Pandemic Unemployment Compensation. Once youve used the Tax.

Type of federal return filed is based on your personal tax situation and IRS rules. However this transitional tool will no longer be available after 2022. The IRS will receive a copy of your Form 1099-G as well so it will know how much you received.

You may also have been eligible for 600 per week on top of regular benefits retroactive to the week ending April 4 2020 through July 25 2020. The IRS also made revisions to the Form W-4. As you fill out the form whether you take a new job or have a major life change you might wonder am I exempt from federal.

The full amount of your benefits should appear in box 1 of the form. The tax is a percentage of. Thats where having your previous tax documents and last pay stub comes in handy.

Fill Out a New Form W-4. The weekly benefit rate is capped at a maximum amount based on the state minimum wage. Please check with your employer or benefits.

You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. Taxable income 87450 Effective tax rate 172. Registration and Filing Requirements How do I register for a withholding tax account.

Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. Pandemic Unemployment Assistance PUA is a federal unemployment benefit program that expanded eligibility to workers. We will calculate your weekly benefit rate at 60 of the average weekly wage you earned during the base year up to that maximumWe determine the average weekly wage based on wage information your employers report.

Please note that for existing claims you will still be eligible to receive benefits for weeks prior to September 4 if you are found eligible for a claim filed before September 4. For 2022 the maximum weekly benefit rate is 804. Results from the calculator will include a recommendation of whether or not users should consider submitting a new Form W-4 Employees Withholding Allowance Certificate to their employers.

Click here for the Request for Change in Withholding Status. In recent years the IRS released updated tax withholding guidelines and taxpayers should have seen changes to their paychecks starting in 2018. Colorado form DR 0004 does not allow exempt claims but an employee with federal withholding could have zero Colorado withholding if the annual allowance on form DR 0004 Line 2 is greater.

How Taxes on Unemployment Benefits Work. Previously filed Oregon or federal withholding statements Form OR-W-4 or Form W-4 which are used for Oregon withholding can remain in place if the taxpayer doesnt change their withholding elections. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the unemployment income you received in 2021. To avoid the possibility of this occurring in step 3 the date the late returnlate payment will be received should be. Withholding Tax and MO W-4 In the 2018 legislative session House Bill 2540 was passed and amended Section 143171 RSMo related to the federal tax deduction.

Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation. Our withholding calculator doesnt ask you to provide personal information such as your name Social Security Number a ddress or bank. The FMV of virtual currency paid as wages is subject to federal income tax withholding Federal Insurance Contribution Act FICA tax and Federal Unemployment Tax Act FUTA tax and must be reported on Form W-2.

You use a Form W-4 to determine the determine how much federal tax withholding and additional withholding you need from your paycheck. Before beginning taxpayers should have a copy of their most recent pay stub and tax return. An employee may claim exempt for federal withholding but still request Colorado withholding by entering the amount per pay period on form DR 0004 Line 3.

Provided an additional 300 per week to all PUA and regular Unemployment Insurance recipients from January 2 2021 through September 4 2021. Type of federal return filed is based on your personal tax situation and IRS rules. If the date you specify in this calculator is earlier than the date the Department receives your late returnlate payment you may receive a bill for additional late filinglate payment penalties and interest owed.

Effective for tax year 2019 the federal income tax deduction taxpayers may claim is prorated based on the taxpayers Missouri adjusted gross income. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development Unemployment Insurance PO Box 908 Trenton NJ 08625-0908. Register online or submit a completed Form R-1.

These benefits expired September 4 2021. The weekly benefit rate is capped at a maximum amount based on the state minimum wage. Notice 2014-21 2014-16 IRB.

The Australian federal government requires withholding tax on employment income payroll taxes of the first type under a system known as pay-as-you-go PAYG. For 2022 the maximum weekly benefit rate is 804. We will calculate your weekly benefit rate at 60 of the average weekly wage you earned during the base year up to that maximumWe determine the average weekly wage based on wage information your employers report.

202223 Tax Refund Calculator. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Use our W-4 withholding calculator for extra guidance Local and State Tax Withholding St Tax ST or SWT.

IRS tax forms. Federal Tax Withholding Fed Tax FT or FWT. Form W-4 tells an employer the amount to withhold from an employees paycheck for federal tax purposes.

15-T Federal Income Tax Withholding Methods available at IRSgovPub15TYou may also use the Income Tax Withholding Assistant for Employers at IRSgovITWA to help you figure federal income tax withholding.

How To Fill Out Irs Form 940 Futa Tax Return Youtube

Futa Tax Overview How It Works How To Calculate

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax Calculator For Employers Gusto

Formulate If Statement To Calculate Futa Wages Microsoft Community

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube

How To Calculate Unemployment Tax Futa Dummies

What Is Futa And How Does It Work Howstuffworks

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

How To Calculate Unemployment Tax Futa Dummies

What Is The Federal Unemployment Tax Rate In 2020

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

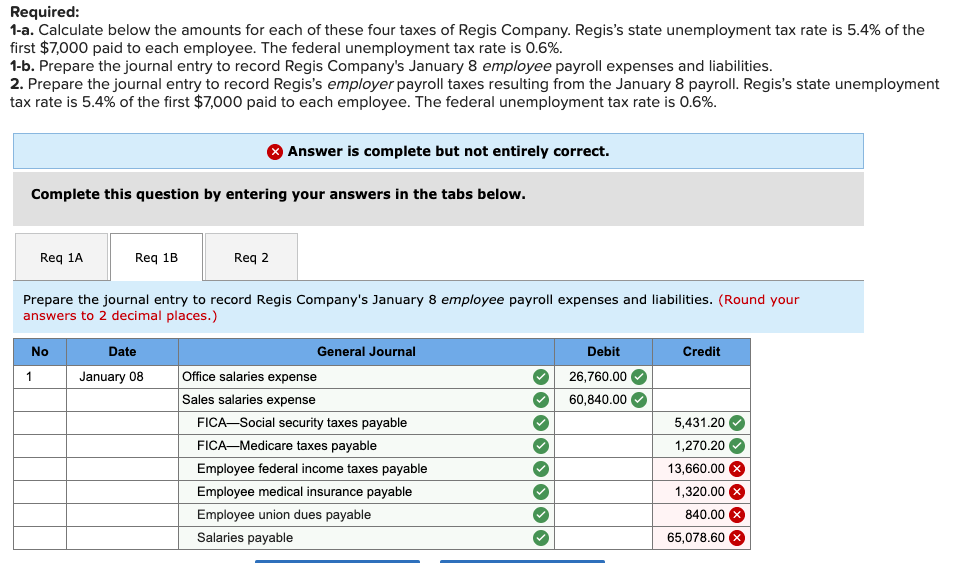

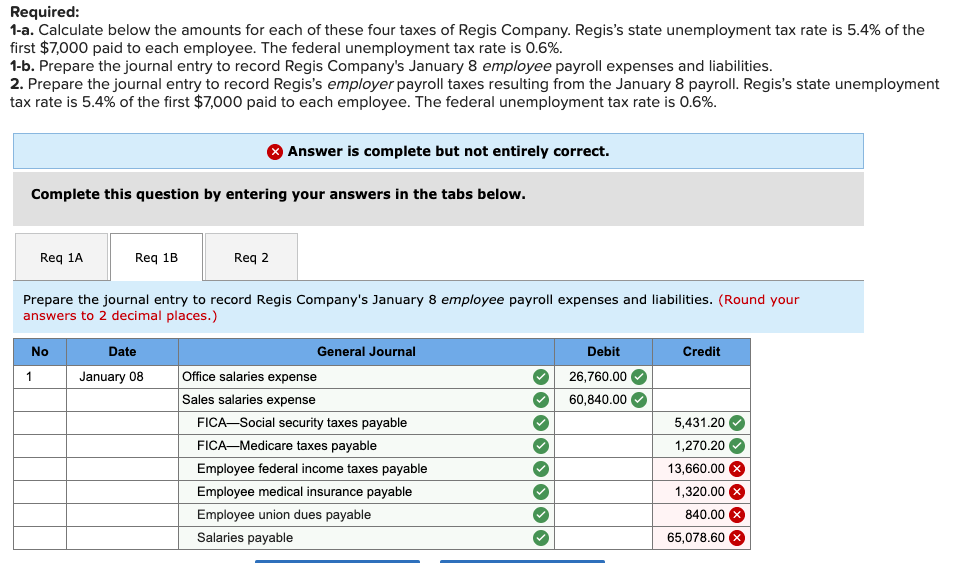

Solved Required 1 A Calculate Below The Amounts For Each Chegg Com

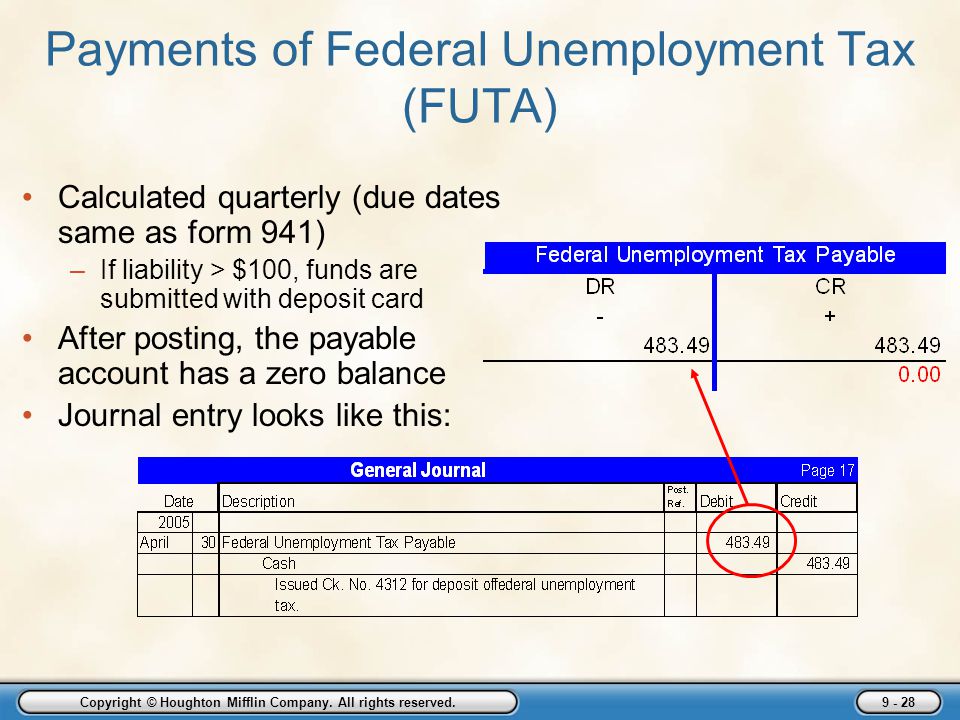

Employer Taxes Payments And Reports Ppt Download

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting